Empowerment Journey Step 6

At this point we’ve made it through the intervention and sworn off using debt as a financial crutch. We also know that building up our savings will offer security that credit never can. Everything starts with being able to live on less money than we bring in each month, which in-turn relies on:

- Maximizing our income by using our interests and skills to add value to peoples’ lives

- Intelligently managing expenses

Here’s our empowerment journey thus far:

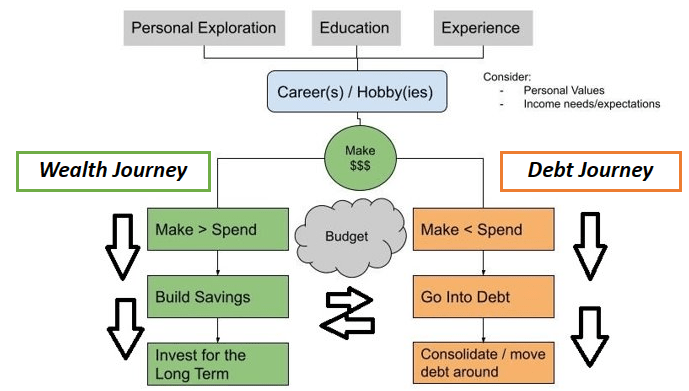

Everyone from Bill Gates to the person taking your order at Wendy’s is doing one of two things financially at any point in time: building/spending wealth or building/paying off debt. No matter how complicated or scary they seem at first, all financial decisions can be distilled down to a choice between these two options.

Look at the diagram above. The gray and light blue boxes about self-exploration and choosing a career were discussed in prior posts here and here. Don’t worry about those now. Starting at “Make $$$”, picture each box in the two columns — green to the left and oranges on the right — as pools of water. When we fill up the pool we’re in, whatever extra we have flows to the next pool/box.

So we start at “make $$$”. Now that we have money, we’ll be buying things. Important things like housing and food, and some less important things. Then we come to an important crossroads: after paying the bills is there anything left or did we spend it all? If there’s money left when our next payday hits, that means we spent less than we made – we filled up the “Make > Spend” pool. In this case, we can use that “little extra” to build up savings – water trickles down into the green “build savings” pool.

If there’s nothing left in the bank and we haven’t gotten paid, then we spent more money than we made. Assuming we are still eating, living in a house, or doing anything with no money is by accumulating debt. This is just math, no judgement here. We need money for stuff, we didn’t make the money, someone lent it to us. That’s debt, so water trickles to the orange “go into debt” box/pool on the right.

Help, I’m on the Wrong Journey!

As human beings, we’re all creatures of habit. So if we spend more than we make, even if our debt starts out small, those bad habits can get reinforced by a society that tells us that debt is ok, even “normal” (that’s why we needed an intervention). One step down the debt journey is no big deal, but continuing on the path long enough that we get accustomed to it is where we get into trouble. You may find – like I did at one point – that you are thousands, even tens of thousands of dollars away from the right path. I know from experience, that feeling sucks.

But don’t get discouraged!

Whichever path we find ourselves on today, every paycheck is a chance for us to make progress. The choice is always the same – spend less than we make and move toward the wealth journey, or spend it all and move further down the debt journey. The good news is wherever you’re at right now, you can always adjust and get moving in the right direction. It may not be easy at first, but it’s never hopeless.

An important thing I’ve learned is that, whatever path we follow, our journey is all about momentum. Debt can start small and snowball, but so can savings and investments – in a good way! The trick is to get on the wealth-building path as soon as possible and keep building momentum once we’re on it. So how do we do that?

I hate to say it, but we have to have a plan. Generals don’t wander aimlessly into battle and hope to win and likewise, we shouldn’t just spend money however we feel in the moment and hope our finances will work out. You might notice the little cloud that stands guardian between the two paths in the diagram above labelled “budgeting”. Some people may dislike that word, I don’t really care for it myself, but whatever you call it, having a plan for the money that comes in and goes out of our bank account will absolutely (“100” emoji) help point us in the right direction. But let’s save budgeting for our next discussion.

Learning to budget is important, but most people (myself included) will never do it just because some finance person tells you that it is. You need to understand at a gut level why it’s important, and the best way to do that is to gaze farther down the journey of wealth and see where it leads.

No Limits

This is the fun stuff. Forget about your current situation, it’s time to think bigger. Like, as big as you can fathom. What would your life be like if your day-to-day choices weren’t limited by the numbers in your bank account? What things might you be able to do that you can’t today? Where might you go? What would it be like to “win the game”? To not have to sell your time for money if you don’t want to?

I’ll go first. I love travelling. Going new places I haven’t been. Meeting new people and seeing how they live. Trying to understand different languages and tasting different foods. Watching the sunset on the beach, gaining a new perspective on life. If I didn’t have to show up at a certain time and do certain things to make sure I have numbers in my bank account, I would do a lot more travelling.

Maybe your dreams are simple – a bigger home for your family or spending more time with your kids or spouse – but I bet removing any financial obstacles would likely be a huge step toward realizing them. Money won’t solve all your problems; there are people with lots of money who are still unhappy. Life is a balancing act and we should consider our physical, spiritual, and emotional health as well as our finances. But not having to constantly face the question, “how do I make more money?” allows us to focus more directly on those other areas.

Building wealth is completely doable. Plenty of people out there have figured out how to win the game. It takes work (“simple, not easy”), but we can get there. There’s no reason why you or I can’t be one of those people. How can we get there?

Wealthy people may have initially made their money hundreds of different ways, but I guarantee anyone who builds serious wealth does one important thing – they invest. So the next step on our journey is focused on getting started with investing, and seeing how far that can take us.

Thanks for reading! Follow me on Twitter to continue the conversation